Forums » News and Announcements

Three Lessons We Can Learn from Robinhood Trader

-

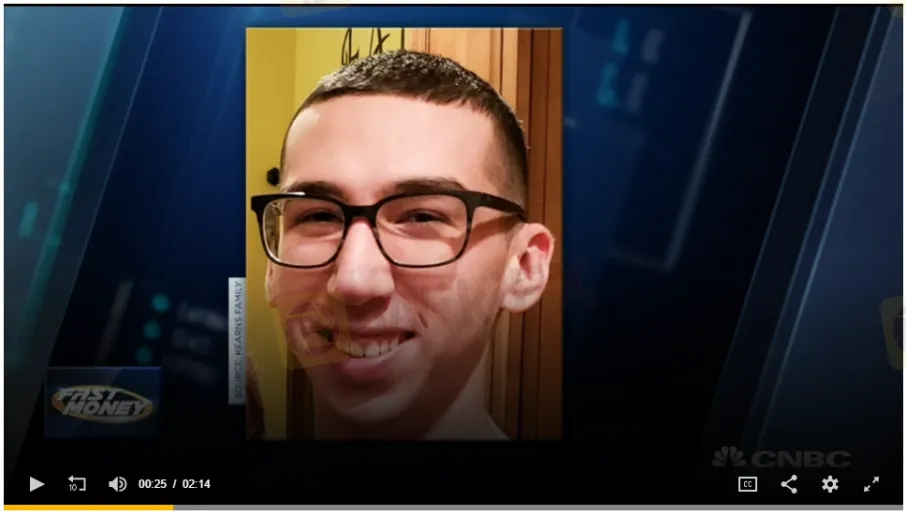

Twenty-year-old commits suicide after seeing what he believed were major losses on Robinhood

“20-year-old Robinhood trader, Alexander Kearns dies by suicide after seeing a $730,000 negative balance.”To get more news about WikiFX, you can visit wikifx news official website.

In the past week, youve probably come across similar headlines on social media.

This tragic incident happened amid the recent increase in account opening and trading volume from retail traders and investors.

Robinhood was reported adding more than 3 million users in 2020 as of May 4, and close to 50% of these new users were first-time investors. As of early June, Robinhood‘s desktop and mobile weekly visitors were up 332% from the year before, according to a research from SimilarWeb. That's more than twice the rate of growth as Robinhood’s next-closest competitor in the wealth management space.

While this is good news for the brokerage firm, it is concerning news to both the retail trading industry and educators like ourselves.

What happened to Alexander Kearns (and hopefully there wont be any more similar cases from the recent increase of “Robinhood Traders”) is a good reminder to all retail traders and investors.

According to his cousin-in-law, Bill Brewster was saying Robinhood should be responsible for his suicide -

“It doesn't make any sense to me. I would think that a tech company that is focused on financial transactions would have the sense to understand that they should display the number to people in a way they can decipher,” he tells PEOPLE. “The fact of the matter is this kid died over nothing. Nothing. He didn't owe a penny... This is finance, this is people's lives.”

“I would argue that if you are playing with people's finances, and it is true that you are driving people to use options... you have got a duty to make sure that people do not sign on and see a number like [$730,165],” says Brewster. “Because you know right now most of those people unsophisticated.”

And there was also the perspective where Kearns wasnt well equipped with the proper knowledge of trading. Before his suicide, Kearns allegedly wrote -

“The puts I bought/sold should have canceled out, too, but I also have no clue what I was doing now in hindsight. There was no intention to be assigned this much and take this much risk, and I only thought that I was risking the money that I actually owned. If you check the app, the margin investing option isn‘t even ’turned on for me. A painful lesson. F— Robinhood.”

While we can respect and understand the differing opinions of who is or should be responsible for this tragic incident, allow me to direct the attention to the following statement written by Kearns -

This indicated that he wasnt well equipped with the necessary knowledge of the trading instrument that he was trading with. According to the articles published, Kearns was likely trading on options.

If youre not familiar with options, this is the one trading instrument (the other is the futures market) that I always encourage traders to avoid, especially if you are very new to trading and investing.

Trading is already challenging in having to get your direction and timing right to profit from the market. In options trading, you need to get the direction, timing, AND the market volatility right to profit from the market.

If getting both factors are difficult already, what makes you think adding a third factor to trading will make it easier?

Generally, options trading can be wildly lucrative, but it is also highly complex and comes with greater risk. Unlike trading stocks or the currency market, in which it is very rare to lose more money than you initially deposit, in certain situations options trading can expose you to losing a theoretically infinite amount of money.