Forums » News and Announcements

Inflation Retreat in Latin America Put to Test

-

Coronavirus cases in Latin Americas two biggest economies -- Brazil and Mexico -- are soaring, leaving the region with its worst recession since at least 1901.To get more news about WikiFX, you can visit wikifx news official website.

That downturn is reflected in consumer prices, with most countries now facing a rare period of disinflation as demand plunges. In May, all the major economies in the region apart from Argentina had an annual inflation rate below 3%.

Data published this week for June are forecast to show year-on-year consumer price increases in Chile and Brazil holding near May‘s levels while Mexico’s probably pushed just over 3% -- still well within the central banks target range.

“After two consecutive months of deflation, Brazil inflation is expected to have risen slightly in June, driven mostly by recovering gasoline prices. Elsewhere, prices remains muted: core inflation readings are threading close to zero and inflation expectations remain well below the target for this year and the next, leaving plenty of room for interest rates to remain exceptionally low.”

--Adriana Dupita, senior economist

Elsewhere, Malaysia and Mauritius may cut interest rates, while central banks in Israel, Australia and Peru are predicted to hold.

Click here for what happened last week and below is our wrap of what else is coming up in the world economy.

U.S. and Canada

It‘s a relatively light week for U.S. data with most eyes focusing on Thursday’s jobless claims data to see if a rush for unemployment benefits remains underway. That follows the JOLTS report on Tuesday which is expected to show the number of unemployed exceeding job openings, highlighting the severeness of the labor market slack. Friday sees the release of producer prices numbers which are set to show factory-gate costs remain weak.

Canada‘s government will release its first estimate of this year’s budget deficit on Wednesday. Thats two day before the country is expected to report another half million workers found jobs last month as pandemic-related restrictions are gradually lifted, a second straight gain that will still leave the unemployment rate at near record highs.

For more, read Bloomberg Economics full Week Ahead for the U.S.

Europe, Middle East and Africa

U.K. Chancellor Rishi Sunak is set to unveil an economic update to Parliament on Wednesday, a week after a speech by Prime Minister Boris Johnson came under criticism for failing to deliver a meaningful stimulus package. For businesses and investors alike, the key will be what the finance chief can promise in the short term to save jobs.

May industrial production figures for countries including Germany, Spain and France could confirm European Central Bank policy makers recent comments that the euro-area recession may be bottoming out.

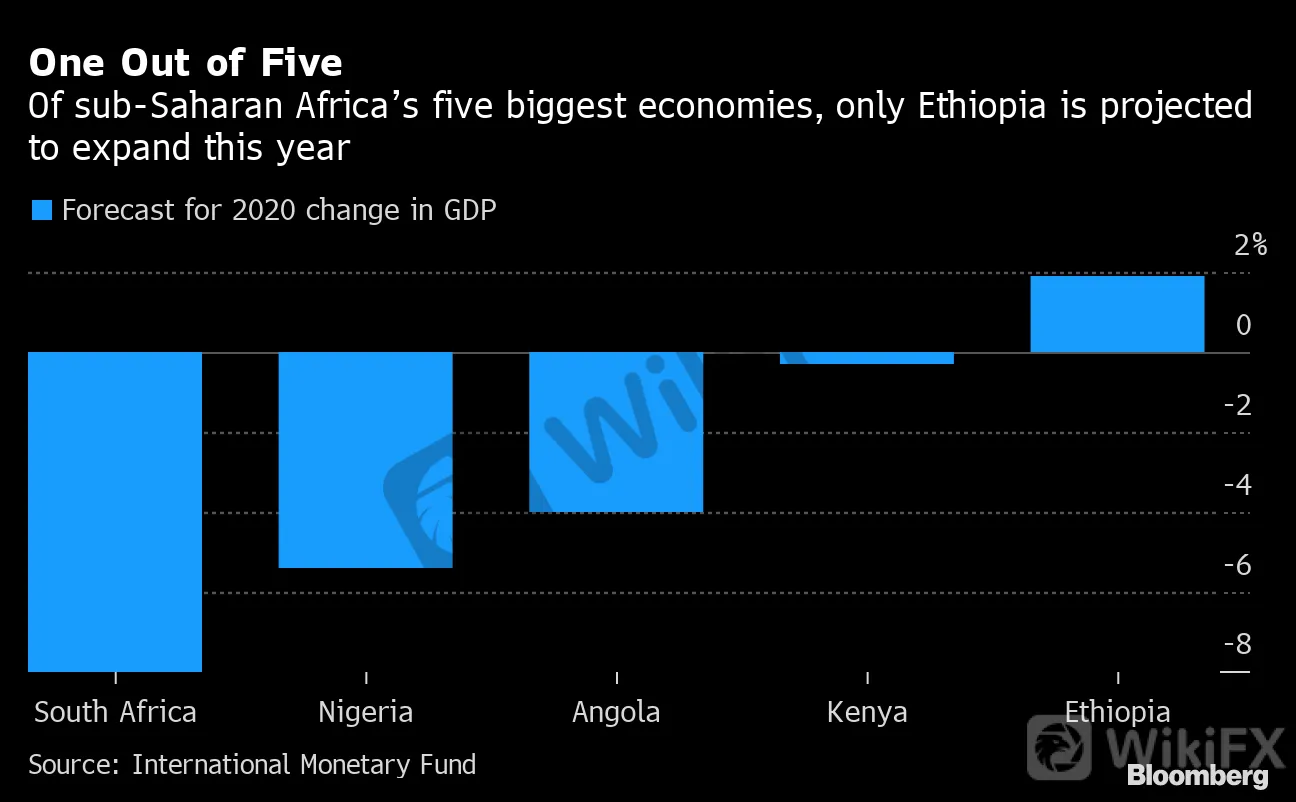

The African Development Bank will probably make significant cuts to its growth forecasts when it releases a supplement to its January outlook on Tuesday: of sub-Saharan Africas five largest economies, only one, Ethiopia, is projected by the IMF to expand this year.

The Bank of Israel will probably hold its main interest rate at 0.1% on Monday, although one of the six members of the monetary policy committee voted at the last meeting for a cut to zero, saying itd be more appropriate given the magnitude of the Covid-19 crisis.