Forums » News and Announcements

Frozen Treasury Yields Belie Hedging Bets on Stronger Fed Action

-

Dwindling volumes in interest-rates markets suggest that the normal summer doldrums are arriving on time, yet underneath the surface there are signs that traders are bracing for more drama ahead.To get more news about WikiFX, you can visit wikifx news official website.

From trades anticipating yield-curve control measures by the Federal Reserve, to lingering bets on negative interest rates and even positions that would benefit from an eventual rate increase by the Fed, traders are searching for the next edge based on what they expect the central bank will do.

The positioning highlights the array of options that remain on the table for Fed policy this summer and beyond, depending on how the economic outlook evolves with the spread of the coronavirus.

The latest read on growth briefly buoyed bond bears on Thursday: Ten-year Treasury yields touched a roughly one-week high of 0.71% after June employment data came in stronger than forecast. Yet in a sign of how uncertain the outlook remains as the virus spreads, that move quickly faded. The rate ended the day at 0.67%, right in-line with its average for the past three months.

Here are some of the possible scenarios that investors and strategists are considering in the months ahead:

Yield-Curve Control

The base-case scenario for many economists is that the Fed will set target yields for certain maturities of Treasury securities by the end of the year, though policy makers appeared unconvinced of the need for that when they met at their June meeting, according to minutes released Wednesday.

Strategies targeting curve control are starting to emerge in rates volatility, such as receiver spreads that bet that the fixed rates paid in interest-rate swaps will remain above the floating rate they‘re swapped for. Barclays late last month recommended similar trades “to express the view that short to intermediate rates can grind lower,” a bet on curve control after the Fed’s policy review in September.

Should the Fed adopt a type of curve control favored by former Chair Ben Bernanke, expect the central bank to rule out targeting rates on securities of more than two to three years maturity. This may trigger more intermediate curve plays in the futures market, such as 5- and 7-year spreads, a popular recent theme. Open interest in 5- and 10-year futures -- a tally of outstanding positions -- has surged, a likely indication that traders are positioning for the prospect of curve control.

Negative Rates

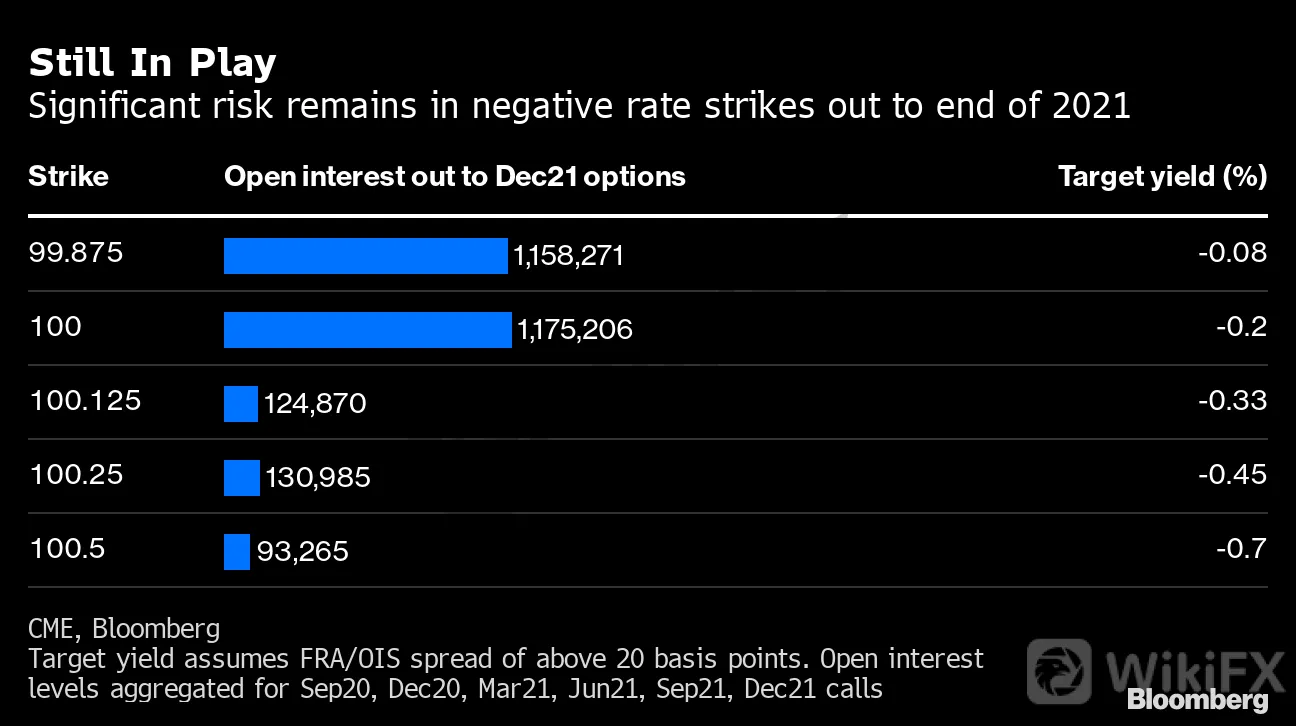

Fed funds futures continue to price in a chance of a negative policy rate from around mid-2021 and positioning for that scenario has been a popular theme in eurodollar options.

While options hedging activity has slowed, there remains a significant amount of risk in calls targeting an equivalent yield of 0% or lower, despite continued push-back from Fed officials. More recently, demand has shifted into mid-curve eurodollar plays which target a negative policy rate for 2022 but with quicker payouts.

The Feds most-recent summary of economic projections shows expectations that the policy rate will be on hold at the current level through 2022. Treasury volatility has subsequently remained at depressed levels over the past two months.

A popular play to benefit from continued subdued volatility has been via Treasury options: selling volatility structures known as straddles and strangles that will be profitable if interest rates remain in tight ranges. A recent trade included a sizable $21 million short-volatility position in 10-year Treasury options.

Low-volatility plays have also emerged in the eurodollar options market. This past week a $6 million wager targeted a potential $25 million payout that benefits from a continued low-volatility environment.